Higher Taxes and Cancer Survival: Study Insights Revealed

In recent discussions about higher taxes and cancer survival, new research suggests a promising connection that could reshape perceptions of taxation and public health. A study published in JAMA Network Open reveals that states generating greater tax revenues tend to see improved cancer screening rates and lower mortality rates. Specifically, for every $1,000 increase in per capita tax revenue, there was a significant rise in screenings for colorectal, breast, and cervical cancers. This correlation implies that higher taxes may fund crucial healthcare initiatives, ultimately affecting societal health determinants and enhancing cancer survival rates. Such findings challenge conventional views on taxes, positioning them as a potential catalyst for better health outcomes, particularly in the context of critical diseases like cancer.

Exploring the intersection of fiscal policy and health outcomes, recent analyses shed light on the relationship between elevated tax rates and improved cancer recovery statistics. The implications of increased state revenues extend beyond mere financial data; they may also provoke enhanced cancer detection efforts and diminished mortality statistics. Notably, when tax funds are allocated towards healthcare resources, they positively influence screening frequency, suggesting a correlation between economic strategies and public wellbeing. In this way, state-level financial policies may serve as pivotal societal health determinants, shaping the landscape of illness management and overall population health.

The Link Between Higher Taxes and Cancer Survival Rates

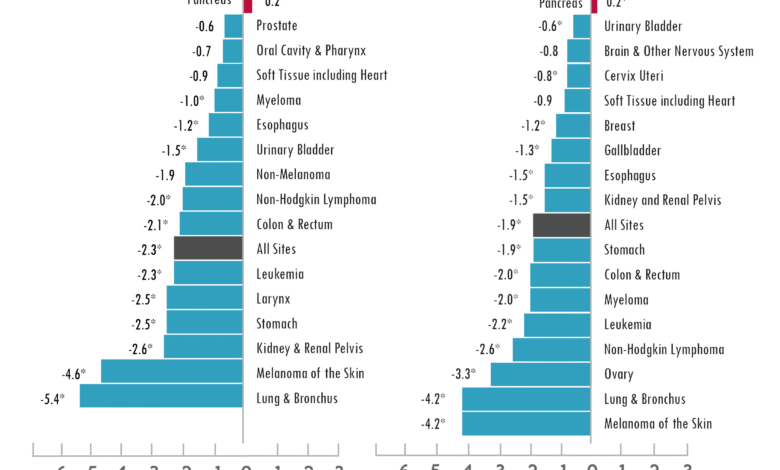

Recent research suggests a significant connection between higher state tax revenues and improved cancer survival rates. The study published in JAMA Network Open revealed that states with robust tax policies can allocate more resources for cancer screenings and public health initiatives. With every increase of $1,000 in tax revenue per capita, there was a notable rise in cancer screening rates, including increases of 2.17% for breast cancer and 1.61% for colorectal cancer. These statistics indicate that higher taxes can have a beneficial role in enhancing health outcomes, particularly in cancer detection and early intervention.

Despite these encouraging findings, the benefits of higher tax revenues on cancer survival seem to vary across different racial and ethnic communities. The study highlighted a concerning discrepancy in mortality rate reductions, where White patients experienced a significant decrease in death rates, while minority populations did not show the same improvements. This indicates potential systemic issues in healthcare access and equity that need to be addressed. Policymakers must focus on ensuring that increased tax revenue translates into equitable access to healthcare services that benefit all demographic groups.

Frequently Asked Questions

How do higher taxes influence cancer survival rates?

Higher taxes can positively influence cancer survival rates by increasing state tax revenues which help fund healthcare initiatives. A study revealed that states with higher tax revenues correlate with increased cancer screenings and reduced mortality rates.

What is the relationship between state tax revenue and cancer screening rates?

Research has shown that for every $1,000 increase in state tax revenue per capita, there is a significant rise in cancer screening rates, including a 1.61% increase for colorectal cancer and a 2.17% increase for breast cancer, which is linked to improved early detection and survival outcomes.

Can higher taxes impact mortality rates from cancer?

Yes, higher taxes can impact mortality rates from cancer. The study indicates that an increase of $1,000 in state tax revenue per capita is associated with up to a 4% reduction in death rates among some cancer patients, suggesting that increased funding from taxes may enhance overall health outcomes.

Why are higher taxes considered a societal health determinant in cancer outcomes?

Higher taxes are viewed as a societal health determinant because they enhance state revenues which can improve access to healthcare services and cancer screenings, thereby leading to better health outcomes and potentially lower mortality rates from cancer.

What limitations did researchers note in the study on taxes and cancer survival?

Researchers acknowledged limitations such as biases in self-reported cancer screening data, cautioning that while their findings underline significant associations between higher taxes and better cancer outcomes, they do not establish direct causation.

How might higher tax revenues lead to better health solutions against cancer?

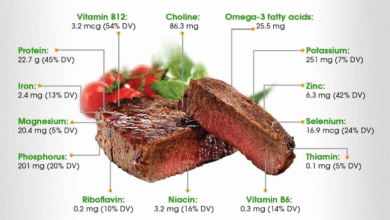

Higher tax revenues can provide funding for healthcare improvements, preventive measures, and programs focusing on better nutrition and access to cancer screenings, which collectively may enhance community health and reduce cancer risks.

What specific cancer screenings improve with higher tax revenues?

Higher tax revenues have been associated with improved rates in several cancer screenings: a 1.61% increase in colorectal cancer screenings, a 2.17% increase for breast cancer, and a 0.72% increase for cervical cancer, demonstrating the positive impact of state tax policies on preventative health.

| Key Point | Details |

|---|---|

| Higher taxes and cancer survival | Higher state tax revenues are associated with better cancer screening rates and lower cancer mortality. |

| Study Overview | A study from Ohio State University, Emory University, and the University of Verona analyzed tax data over 23 years (1997-2019) in the U.S. |

| Tax Revenue Effects | For every $1,000 increase in tax revenue per capita: – 1.61% increase in colorectal screenings – 2.17% increase in breast screenings – 0.72% increase in cervical screenings |

| Mortality Rates | Among cancer patients, a $1,000 rise in tax revenue per capita equals up to a 4% drop in death rates for White patients, but not for minority groups. |

| Implications | The study suggests that increasing state-level tax revenues can improve access to healthcare and cancer screenings, influencing overall survival rates. |

| Expert Insight | Dr. Marc Siegel emphasizes the positive impact of higher taxes on nutrition, healthcare access, and preventive measures against cancer. |

| Study Limitations | The researchers caution that while there are associations, the study does not prove causation due to potential biases in data collection. |

Summary

Higher taxes and cancer survival are intricately linked according to recent research. The study points out that higher state tax revenues can lead to increased cancer screenings and reduced mortality rates among certain populations. This suggests a crucial role for state-level tax policy as a determinant of health, potentially responsible for enhanced public health outcomes. While the findings are compelling, it is important to recognize the limitations and focus on the need for targeted health interventions that address disparities among different racial and ethnic groups.